With the current focus on mortgage rates and the housing market, homeowners may be wondering about how much equity they have in their homes. But how can you come up with this figure and what can it be used for?

Why you may want to calculate equity

There are many common reasons why you may need to understand how much equity you have in a property. The most common is when remortgaging, when you need a good understanding of the amount you are requesting from the bank or building society. With more lenders willing to cut rates now that inflation has calmed slightly, many homeowners are choosing to remortgage rather than stay on sky-high variable rates.

There are also many life events when it might become necessary to understand how much equity is in a home, such as bereavement or when taking out a life insurance policy.

It’s also advisable to do an equity review in the case of blending of assets through marriage or cohabitation. As a result, many couples get Deeds of Trust put in place by specialist lawyers such as https://www.parachutelaw.co.uk/transfer-of-equity-solicitor as a way to protect their respective equities.

Understanding equity will almost definitely be necessary in the case of divorce. You may need to provide these numbers as part of the divorce negotiations or to a transfer of equity solicitor if equity is to be divided.

How to calculate equity

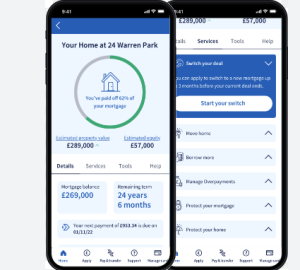

Put simply, equity is how much of the property you have paid off (the amount of money you have put in, not including interest) plus the added value of the home since you bought it.

To calculate equity, you will first need to get an accurate property valuation, ideally from at least two local estate agents who know your area well and how much similar properties are currently selling for. While most estate agents value properties for free if you intend to sell, valuations for other purposes can sometimes be charged for. This may be worth the expense.

You then need to check your mortgage balance. This is available on most mortgage statements or you can call your bank.

You then subtract the mortgage amount from the value of the property (but take into account any other loans secured on your home as well). Now you know how much equity you have in your house.