Knowing how to improve personal finances is a secret that everyone wants to know. However, it is not about following magical recipes or having a personal financial advisor, it is simply a matter of ordering finances and maintaining strict habits. This will allow you to avoid falling into gigantic debts or simply to save a little extra money month by month.

The importance of being able to manage personal finances lies in being able to live comfortably with the income, having the possibility of saving and without spending more.

How to improve personal finances?

Eliminate unwanted expenses

One of the main tips to improve personal finances is to eliminate all kinds of superfluous expenses, not counting those that are personal tastes and that you really enjoy, although these can represent a considerable expenditure of money every month. According to Elena Prokopets, an expert in educational content for startups, it is more important to be able to cut expenses in those areas that you dislike to pay so that you can enjoy your income without guilt.

It is not about eliminating all those expenses because many times these are unavoidable payments, impossible to eliminate, for example, the mobile phone account or car insurance. The secret is to reduce these expenses to the maximum to pay only what is necessary, without overpaying. For this, you have to review the contracts and plans offered by different companies to find the one that best suits your needs or negotiate to pay only what you actually use per month.

Manage your finances online

The use of online banking allows you to greatly simplify the management of your finances. The ability to pay bills through the Internet, allows you to cancel everything on time to avoid interest and charges for late payments. While it may seem that they are small sums, the truth is that if this happens every month, you can save a lot of money if you start paying your debts on time. In addition to this, managing your expenses and income online will allow you to analyze the same and detect if you are spending too much money or if you can start saving.

Create extra money sources

Another very useful advice from Elena Prokopets is to take every opportunity to generate extra income, in any way. This does not necessarily mean taking a second job, but simply finding opportunities to earn a little extra money. According to Prokopets, this includes renting an extra room on Airbnb and doing small freelance jobs on the web. The important thing is to find options and not waste opportunities to earn a little money that you can use to save or to give yourself some tastes.

Check This Out: How Many Credit Cards Are Sufficient?

Prepare a monthly budget

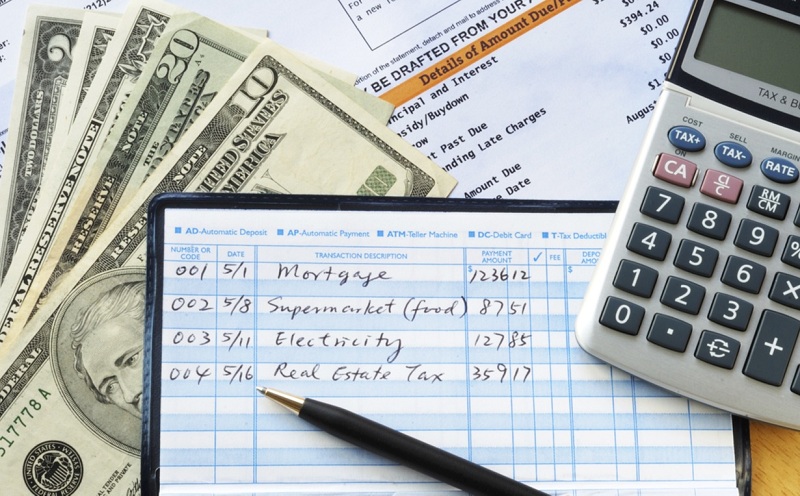

It is not about writing down each of the expenses because it is a rule that can be fulfilled for a while, but then it can become somewhat strenuous. A practical way to prepare a budget is to determine the types of fixed monthly expenses such as rent, credit card, and payment of services. This will allow you to have a global overview of your finances and it is not necessary to do it on a daily basis. You can also incorporate a monthly percentage of your income to allocate money to savings and thus have a small shelter in case of unforeseen events. The rest of the money is what you will have available for your daily expenses and even for some personal taste.

Keep expenses organized

The secret to improving personal finances is simply to maintain a discipline and organization of monthly income and expenses. This will allow not only have money available to save but also the possibility of spending on what you need without this messing up your finances in a chaotic manner. The organization and planning are the best allies to order and improve personal finances.

You May Read Also: Reasons You Cannot Save And How to Fix It